CORPORATE GOVERNANCE

Our business is all about risk management. To assure the protection our clients paid for, we have to manage carefully our own assets and to comply with the laws regulating our sector. As a result, it is essential for GGI to have a sound corporate governance especially to oversee how we are managing our risks. Therefore, our Board has set up 4 committees to monitor how GGI is conducting its business.

Our Articles of Association can be found here

GGI has set up its Code of Conduct.

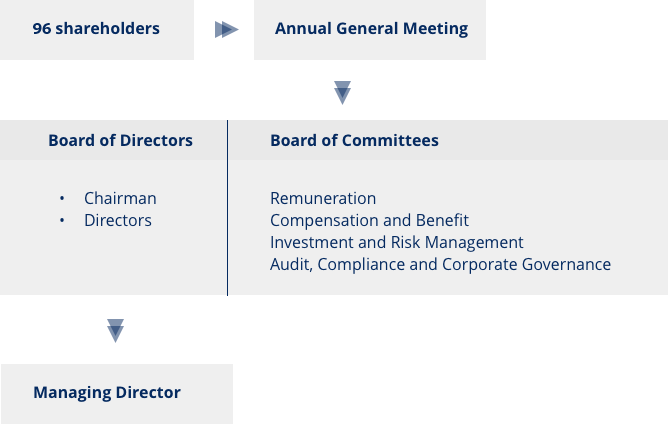

OUR CORPORATE GOVERNANCE STRUCTURE

GENERAL MEETING

Shareholders are meeting during AGM and EGM to:

- Elect the Directors of the Board. They will then act on their behalf, to safeguard the Company’s interests,

- Approve the financial report, the auditor’s report, the directors’ report.

- Validate the GGI’s strategy, the Directors’ remuneration and the allocation of GGI’s resources, especially:

- the amount which will be used to invest and develop GGI’s assets.

- the dividends paid by the Company to its shareholders.

Our annual report contains more information regarding GGI’s AGM.

Board’s Responsibilities

The main duty of our Board is to ensure the sustainability of GGI business. Therefore, The BOD members are responsible for steering GGI business. Board’s responsibilities are broad and include the following elements:

- defining and reviewing GGI’s strategy, and its implementation regularly,

- validating and challenging GGI’s corporate policies and organization,

- reviewing and approving GGI’s major investments to achieve its strategic goals,

- ensuring the compliance of GGI with Myanmar laws and regulation, overseeing the management, and the control environment.

The Board is also responsible for reviewing the Company’s mission and values.

Chairperson’s Responsibilities

Elected by the Board members, the chairperson of the Board chairs the general meetings. Its responsibilities include that:

- the Board meetings are conducted accordingly to the Company’s Constitution,

- Board members have the right skills and information to make the right decision for safeguarding the Company’s interests,

- Directors’ remuneration is fair, and reflect their contribution to develop GGI’s assets,

- Board performance is evaluated on a regular basis.

Our regulatory notices provide information on a variety of policies and topics

BOARD OF DIRECTORS

For the last financial year (2017/18), our Board of Directors met 2 times.

| Name | Shareholders | Role | Board Meetings’ Attandance | Other directorship in listed companies | Date of first appointment | Last re-elected | |

|---|---|---|---|---|---|---|---|

| U Aik Htun | X | Chairman | Non Executive | 100% | – | 2012-2013 | 2017-2018 |

| U Aung Zaw Naing | X | Vice Chairman | Executive | 100% | – | 2012-2013 | 2016-2017 |

| U Aik Yee | X | Vice Chairman | Non Executive | 100% | – | 2012-2013 | 2016-2017 |

| U Myo Naung | X | Managing Director | Executive | 100% | – | 2012-2013 | 2017-2018 |

| U Aung Than | X | Director | Non Executive | 50% | – | 2012-2013 | 2016-2017 |

| U Ye Myint | X | Director | Non Executive | 100% | – | 2012-2013 | 2017-2018 |

| U Hla Oo | X | Director | Non Executive | 100% | – | 2017-2018 | |

| U Win Htay | X | Director | Non Executive | 100% | – | 2012-2013 | 2017-2018 |

| U Soe Paing | X | Director | Non Executive | 50% | – | 2014-2015 | 2017-2018 |

| U Myo Nyunt | X | Director | Non Executive | 100% | – | 2012-2013 | 2017-2018 |

| U Tin Maung Latt | X | Director | Non Executive | 100% | – | 2015-2016 | 2017-2018 |

| U Maung Maung Aye | X | Director | Non Executive | 100% | – | 2012-2013 | 2016-2017 |

| Daw Sandar Htun | X | Director | Non Executive | 0% | – | 2012-2013 | |

| Daw Nan Khin Htun | X | Director | Non Executive | 100% | – | 2014-2015 | 2017-2018 |

| U Zaw Myint Htoo | X | Director | Non Executive | 50% | – | 2012-2013 | 2016-2017 |

BOARD COMMITTEES

Audit, Compliance and

Corporate Governance Committee

This committee is formed with board members and at least one of them has financial experience. The number of committee members can be updated if needed to cope with a more important workload.

The responsibilities of this Committee are:

- Ensuring the compliance with the Myanmar Companies Act, and any other rules and regulations issued by the relevant authorities,

- Reviewing the Financial statements of GGI,

- Recommending an external auditor for the shareholders’ approval during the AGM.

The Committee met once during the last financial year.

| Role | Meetings’ attendance | |

|---|---|---|

| U Myo Naung | Member | 100% |

| U Win Htay | Member | 100% |

| U Myo Nyunt | Chairman | 100% |

| U Zaw Myint Htoo | Member | 100% |

Compensation and Benefit Committee

The objective of the committee is to ensure that GGI’s clients receive the right benefits. This committee is formed with BOD members, and at least one of them should have a strong experience in the industry sector. The number of committee members can be updated if needed to cope with a more important workload.

This committee met twice during the last financial year.

U Tun Kyaing, GGI’s Deputy Managing Director, is the committee secretary.

| Role | Meetings’ attendance | |

|---|---|---|

| U Aik Yee | Chairman | 100% |

| U Ye Myint | Member | 50% |

| U Tin Maung Latt | Member | 100% |

Investment & Risk Management Committee

The Investment & Risk Management Committee is mainly responsible for ensuring that GGI risk management system is sound and that the risks are managed appropriately to protect the Company’s assets. This committee is formed with BOD members, and at least one of them should have a strong experience in the industry sector. The number of committee members can be updated if needed to cope with a more important workload.

The Committee met once during the last financial year.

U Htin Kyaw Kyi, GGI’s head of risk management division, is the committee secretary.

| Role | Meetings’ attendance | |

|---|---|---|

| U Aung Than | Member | 100% |

| U Maung Sai | Member | 100% |

| U Maung Maung Aye | Chairman | 100% |

Remuneration Committee

The main committee responsibility is to review the consistency and fairness of the remuneration scheme for GGI people.

This committee is formed with BOD members. The number of committee members can be updated if needed to cope with a more important workload.

The Committee met once during the last financial year.

Daw Hnin Sein, GGI’s head of corporate insurance business division, is the committee secretary.

| Role | Meetings’ attendance | |

|---|---|---|

| U Soe Paing | Chairman | 100% |

| Daw Sandar Htun | Member | 100% |

| Daw Nan Khin Htwe | Member | 100% |

RISK MANAGEMENT

The Risk & Management Committee is responsible for overseeing GGI’s risks, and to safeguard GGI’s capacity to conduct its activities. The risks are reviewed and updated regularly by the Risk & Management Committee which will validate GGI’s risk appetite and, the actions plans to mitigate the different risks prioritized.

For the time being, GGI’s main risks are summarized in the following table:

| Risk | Consequence | Risk Management |

|---|---|---|

| Market – The inability to access the reinsurance market abroad may impact the development of the insurance market in Myanmar. | To be protected, and to protect their clients, insurers need to reinsure some of the risks they are facing. Without easy access to reinsurance, they might not be able to expand the kind of risks they are covering (like environmental risks due to climate change). | GGI is working closely with all relevant stakeholders to share its concerns, and advocate to facilitate the access to reinsurance market. The company is working closely with potential partners to reinsure certain of its risks when it might become possible. |

| Legal – the market’s liberalization, and transformation may take longer than expected to be enforced. | To transform its activities, GGI has to invest to reinforce its assets, primarily its IT infrastructure to expand its range of products and services. Any evolution in the legal landscape may impact the profitability of its operations, and its ability to create long-term value. | GGI is assessing the evolutions of the Myanmar market frequently, to make sure its strategic planning is relevant and consistent. |

| Market – the competition in the market may become fiercer, and may impact GGI’s ability to operate. | Foreign insurers may enter the Myanmar market soon, which may impact GGI’s business and market share. | GGI is considering different scenarios to maintain – and even reinforce – its leadership by seizing any opportunity which may help the Company to grow its business. |

| HR – the Group may not be able to recruit the right talent to fuel its development. | GGI needs to attract new talents to expand its operations, and to reinforce the quality of the services provided to its customers. | The HR function is responsible for setting up sound process to manage and grow GGI’s human capital. |

CORPORATE POLICIES

The Board is responsible and accountable for updating and enforcing these policies among other:

| Policy | |

|---|---|

| Code of Conduct | Download PDF |

| Company’s constitution – AOA – MOA | Download PDF |

ASEAN CORPORATE GOVERNANCE SCORECARD

In 2018, GGI contributed to a joint initiative led by the SECM, DICA, YSX and the support of IFC which objective was to assess the current practices of Myanmar companies regarding corporate governance against the ASEAN Corporate Governance Scorecard. GGI’s results are available here.